Abstract:

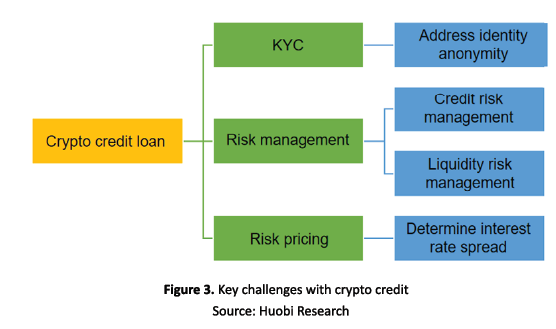

Decentralized lending protocols have always been an important part of decentralized finance (DeFi), but the lending business in the DeFi market has stagnated recently due to the lack of diversity in collateral types and flagging market value. Crypto credit lending, which is emerging as the future trend of the market, has grown rapidly in the past year. It has the advantages of a low threshold requirement and low costs, but when applied to the blockchain there are three key issues: Know Your Customer (KYC), risk management and risk pricing.

Taking three mainstream projects in the current crypto credit market as examples, this paper analyzes the functions and revenue-cost mix of all participants involved, and evaluates the advantages and disadvantages of their risk management model and pricing model.

The current pricing and risk management model of the crypto credit market is still relatively immature. There is still a need to step up risk management, develop interest rate pricing linked to a market-based mechanism, and support lending to on-chain legal entities.

1. Prevalence of Crypto Credit Loans

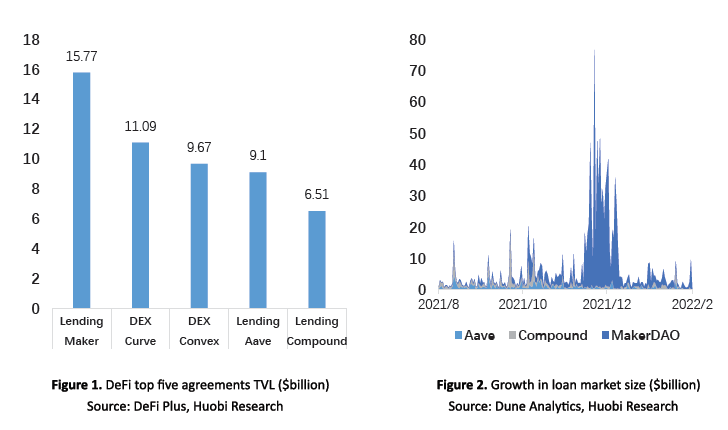

Decentralized lending protocols have been seen as an important part of DeFi since the rise of the latter in 2020. According to the latest data from DeFi Plus, 3 of the 5 top-tier projects fall in the category of lending. However, due to changes in the market environment and limitations of DeFi lending protocol itself, the growth of lending protocols on DeFi has stagnated or even shrunk since November last year.

It is well known that in the modern economic system, expansion of credit is the main driver of economic growth. However, due to the anonymity of blockchain and the high volatility of cryptocurrency prices, the main form of DeFi lending protocol is currently with excess mortgages (NB: Aave’s flash loans do not require collateral). This is similar to a mortgage loan under the modern banking system, where the principal correlates to the value of the collateral. Meanwhile, the types and market value of collateral are limited, and the borrowing cost is high, which restricts the further expansion of the lending market on the whole.

From the perspective of future trends, the degree of maturity in credit lending will be key to the future growth of the crypto lending market. From the view of market demand, with more institutional traders and crypto enterprises, the demand for credit lending has also increased. Particularly for institutional traders that conduct arbitrage or market-making transactions, a large amount of funds has to be injected into the exchange in advance, at which point the need for credit lending becomes critical. That’s why lending platforms such as Genesis were able to maintain high growth and yields over the past few years — borrowers can still profit from trading or market-making even when credit rates are high. However, for centralized platforms such as Genesis, their credit business takes place off-chain, characterized by high interest rates and a lack of transparency, as well as the problems of misappropriation and risk-reward mismatch. On-chain crypto credit lending, which is built with market-based mechanisms and smart contracts, has attracted mass attention and grown rapidly in the past year.

2. Development Model of On-chain Crypto Credit Lending

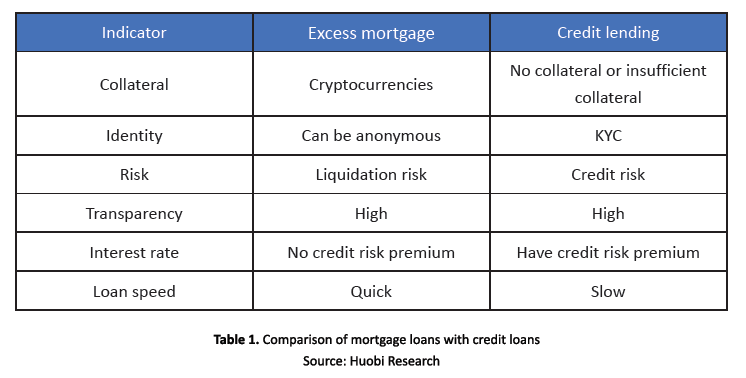

In contrast with the current excess mortgages lending model, credit lending does not require collateral, which greatly lowers the threshold and cost of lending. On the other hand, although the credit lending model does not have the liquidation risk of collateral, it comes with credit default risk which is reflected in the differences in identity authentication, lending speed and loan interest rate.

In general, the following challenges have yet to be resolved to boost the development of the credit business:

1. KYC

The anonymity of the blockchain network has been a key factor hindering the development of the crypto credit market. The lack of identity authentication and background checks on the borrower contributes to a high risk of default.

2. Risk management

Compared with traditional finance, the crypto credit market lacks a track record and data, and new technical models need to be developed to measure crypto credit risk and portfolio management. More importantly, traditional credit implements risk management off-chain. The execution of risk management for crypto credit on-chain is no small challenge.

3. Risk pricing.

Due to the homogeneity of collateral, excess mortgages can complete interest rate pricing in accordance with market mechanisms. However, due to the differences in entities, the risk premium for crypto credit will be different, and pricing will be more difficult.

KYC is the basis for the development of the credit lending business. Since it is difficult to perform KYC verification on-chain, the most appropriate way is to carry out KYC verification on the borrower in advance off-chain.

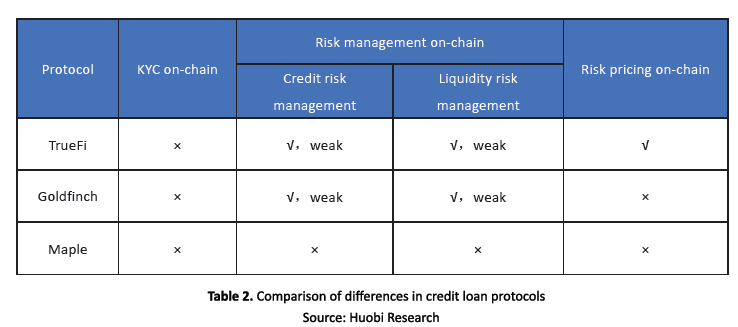

When the challenge of KYC is addressed, there is only one technical issue left: risk management and pricing. For any credit lending model, no more than three parties are involved: the borrower, lender, and risk manager. Differences in risk management models lead to variations in credit lending models: From the perspective of decentralization, TrueFi has the highest degree of decentralization, enabled on-chain credit risk management and pricing. Goldfinch is second to TrueFi, processing risk through structured design on-chain. Maple is relatively centralized, completing KYC, credit risk management and pricing off-chain.

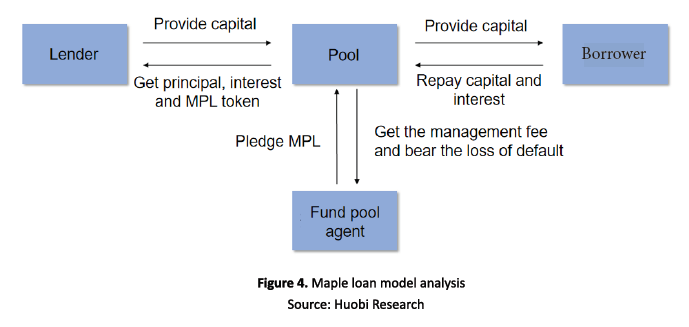

i). Off-chain risk management model — Maple

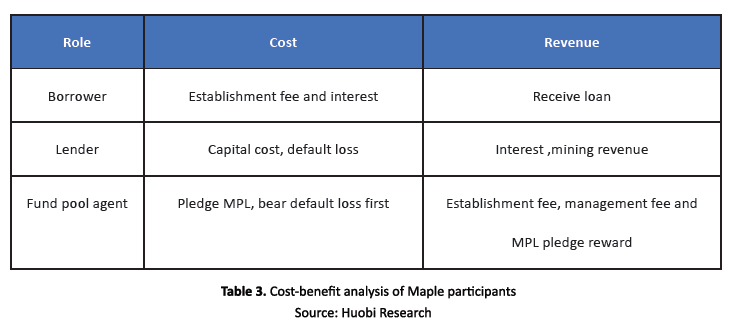

Maple.finance is the simplest model among the three major credit protocols. It adopts the fund pool agent model, and completes the KYC audit, risk management and risk pricing off-chain. Specifically, Maple’s model involves three parties: borrowers, lenders, and fund pool agents, whose responsibilities are as follows:

√ Borrowers: Submit KYC, complete the audit off-chain, and reach agreement on the loan interest rate, amount, time, etc.

√ Lenders: Provide funds and deposit into a specific fund pool.

√ Fund pool agents: Create loan pool, responsible for borrower verification and loan approval.

Therefore, Maple completely leaves risk management and pricing to the fund pool agent off-chain, but only processes the transfer of funds on-chain. This is not fundamentally different from centralized lending platforms such as Genesis.

However, it should be noted that Maple has three important safeguards to ensure the security of funds and enhance lenders’ confidence. First, when conducting off-chain evaluation, it will require certain collateral guarantees based on the borrower’s credit and financial situation. Second, when the agent defaults, the assets pledged by the fund pool agent will be liquidated first. Third, a single fund pool is allowed to lend to multiple borrowers, which spreads the risk.

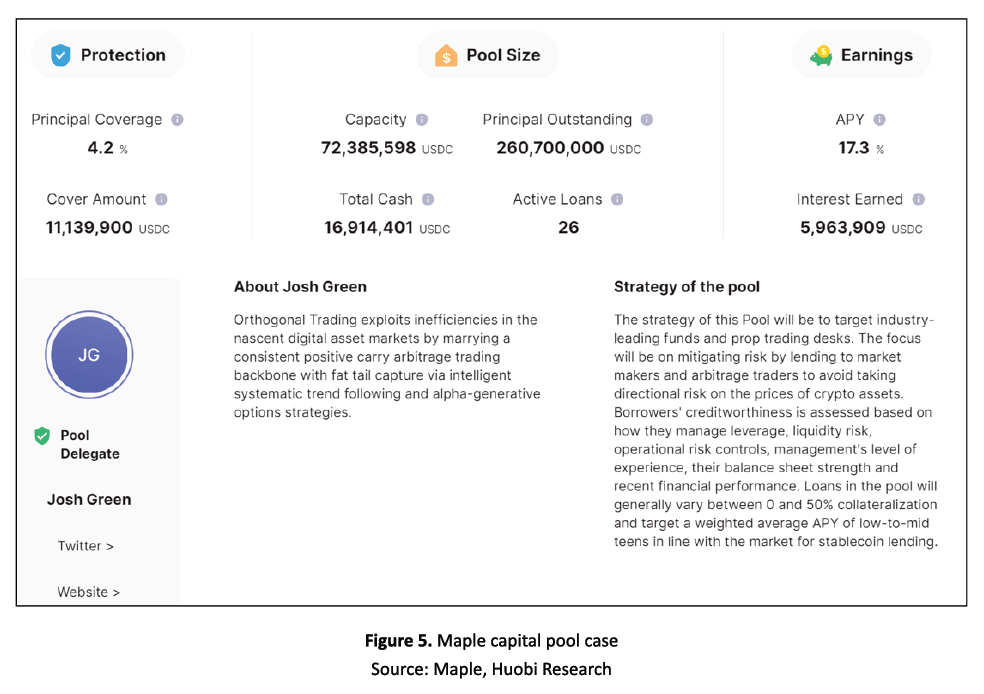

The figure below is a typical asset pool on Maple. From the figure, we can see that the asset pool has a total capital of $200 million, with 26 loans issued and a principal coverage ratio (mortgage ratio) of 4.2%. There are more than $10 million in guarantees, which effectively protects investors. On the other hand, the fund pool also states information about the agent and the purpose of the loan, which reduces lenders’ concern.

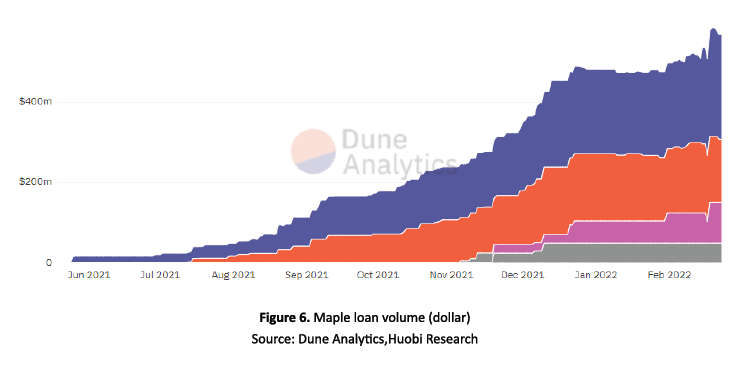

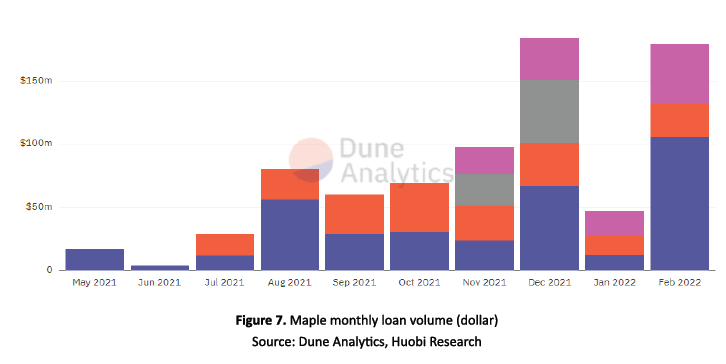

While not much innovation is seen in Maple, it still leads the market with its transparency and safeguards. From on-chain data, the historical loan volume on Maple has exceeded $500 million, and the monthly loan volume issued has also exceeded $100 million.

ii). On-chain risk management model — GoldFinch

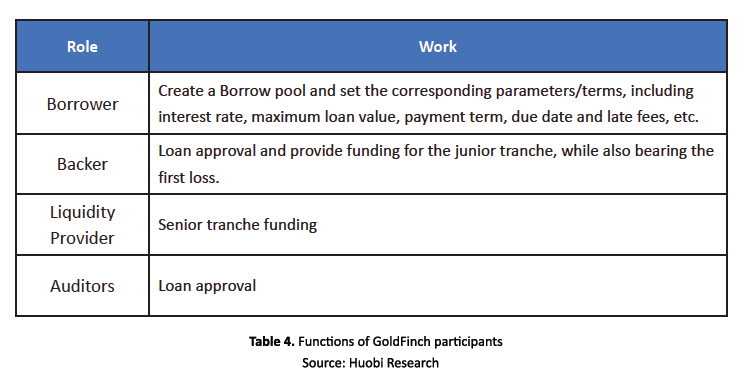

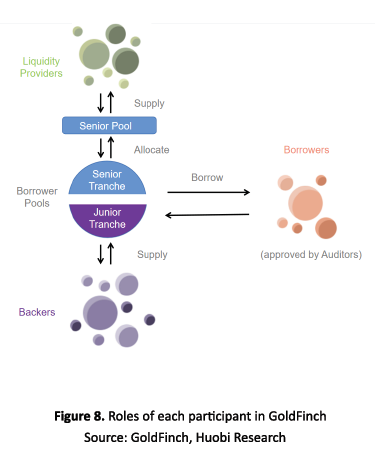

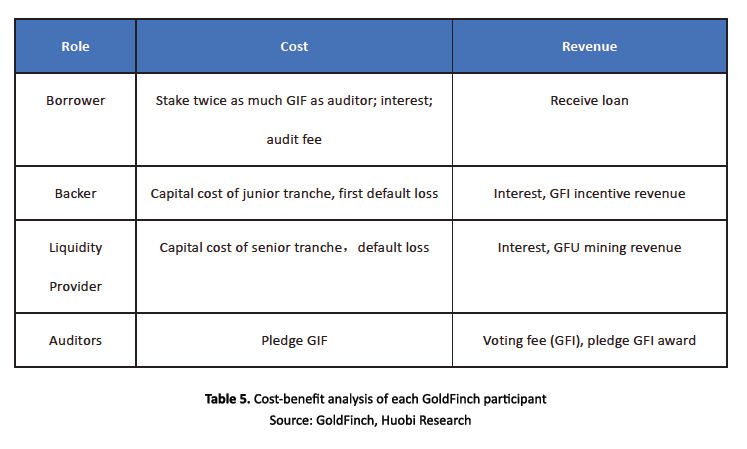

Compared with Maple’s off-chain risk management, GoldFinch adopts a structured design and employs on-chain governance to manage credit risk. Specifically, there are four key parties on GoldFinch: Borrowers, Liquidity Providers, Backers and Auditors. The main functions of each participant are as follows:

When borrowing on GoldFinch, KYC-verified borrowers first create a Borrow Pool and set the corresponding parameters/terms. The Borrow Pool consists of a junior tranche and a senior tranche. The former is funded by backers, and the latter by liquidity providers. In the initial stage, backers will audit the loans and decide whether to fund the junior tranche in the Borrow Pool. Subsequently, the senior tranche will allocate a certain amount of funds to the Borrow Pool according to the leverage model. Finally, when the Borrow Pool has raised at least 20% of its capacity and has pledged enough GFI to reward the auditor, the latter will audit the loan and vote for approval. The borrower can only get the loan after the vote is passed.

It is worth noting that the leverage model combines the management of credit risk and liquidity risk — the amount of funds (A) allocated by the senior tranche to a specific Borrow Pool are determined by the following formula:

A=S∗D∗L

In this formula, S is the funds provided by backers. D is the adjustment coefficient on concentration of the supporters, where the range is [0, 1] to prevent undue system liquidity risks brought by excessive concentration of supporters. When supporters are evenly distributed in each Borrow Pool, its value is 1; when the support is concentrated in a single asset pool, its value is 0. Specifically, it is determined by the formula of the Herfindahl-Hirschman Index.

L is the leverage ratio, which correlates to the number of supporters. If there are many supporters, the credit risk is low, and the leverage ratio of the junior tranche can be relatively high at this time, otherwise the leverage ratio is low so as to control the credit risk faced by the junior tranche.

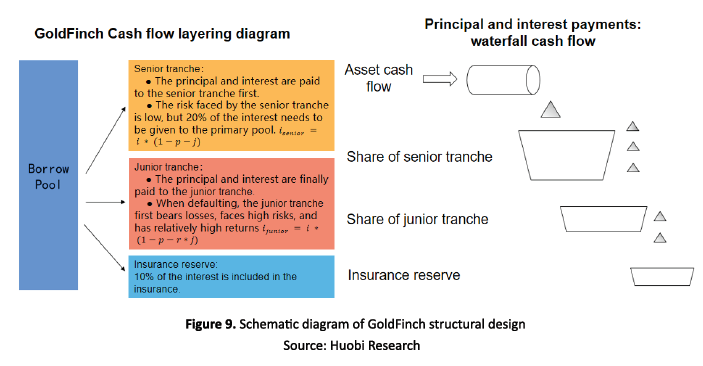

On the whole, GoldFinch does not use the same principal coverage ratio as Maple and insurance funds provided by risk managers to ensure the safety of funds. It adopts a structured design similar to ABS, with a junior tranche comprising supporters for high-risk profits, and a senior tranche comprising liquidity providers for low-risk profits. This results in risk transfer to protect liquidity providers.

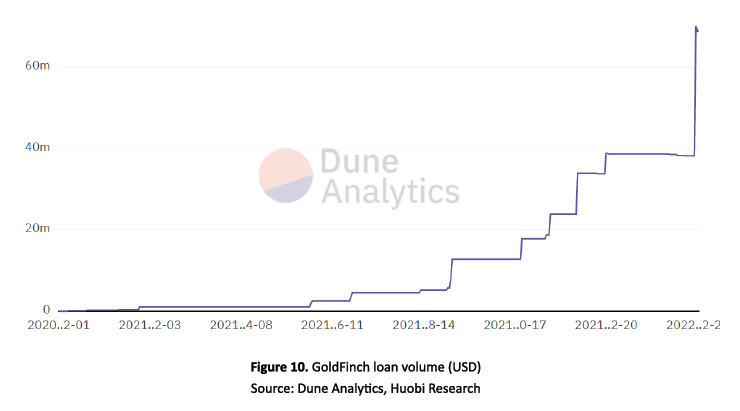

However, GoldFinch’s design mechanism has two major defects. First, the risk pricing is unilaterally set by the borrower, which reduces flexibility. Second, GoldFinch does not significantly reduce credit risk, but only reallocates risk across different lenders. As significant as the role is played by supporters, not all investors are willing to be like“Columbus” to share the joy from discovering a new continent. As a result, GoldFinch is experiencing slow growth, with only $70 million in lending volume currently.

iii). On-chain risk pricing model — TrueFi

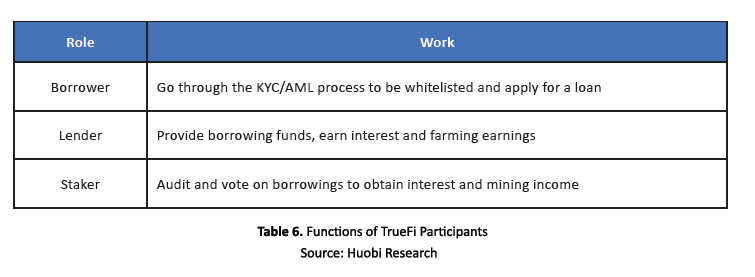

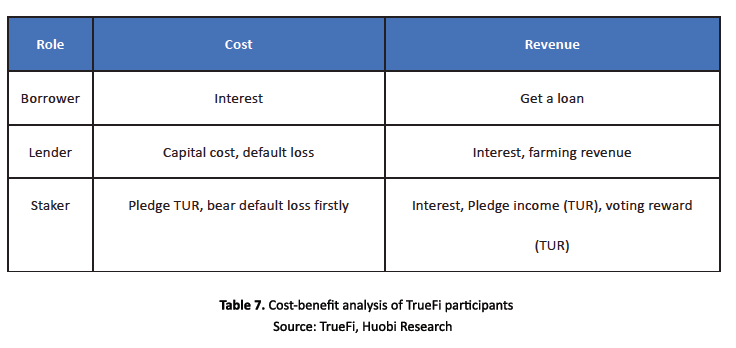

As the current leader in crypto credit, TrueFi not only carries out on-chain risk management, it also offers on-chain risk pricing which gives it greater transparency and flexibility compared with TrueFi and GoldFinch. In contrast with GoldFinch’s two roles of Backer and Auditor which manage risk on-chain, TrueFi has an additional role of Staker to carry out risk management on-chain. Specifically, there are three key roles on TrueFi:

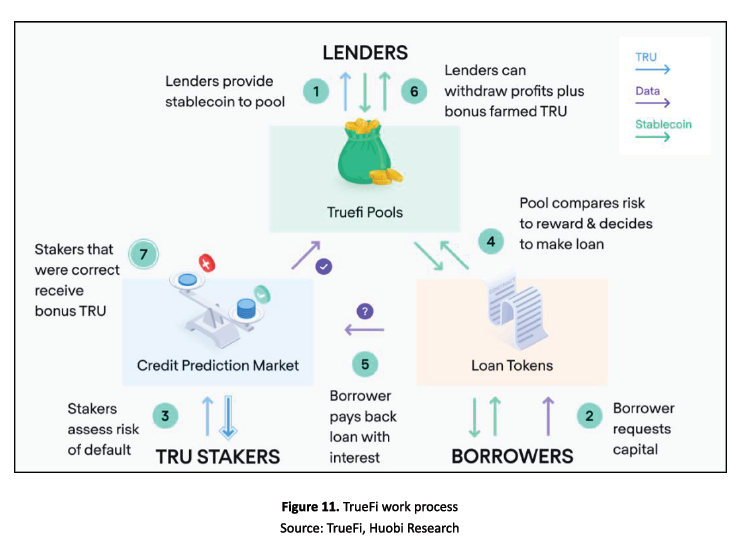

TrueFi works as follows:

1) Lenders contribute assets to the TrueFi loan pool, for which lenders earn interest and TRU. Any unused funds are sent to the Curve.fi protocol to maximize returns.

2) Borrowers are whitelisted through a rigorous KYC/AML process that involves an in-depth review of the company’s business, signing of executable loan agreements, and approval by the TRU community.

3) After the borrower meets the borrowing qualification, the institution’s marginal rate and credit limit will be determined according to the credit scoring model, and the TRU community will vote to approve the loan. TRU stakeholders must vote carefully because in the event of a loan default, their staked TRU will be liquidated (up to 10% of staked TRU) to protect lenders in the event of a default.

4) The borrower must repay the principal and interest before maturity. Delinquent borrowers will face litigation under previously signed loan agreements.

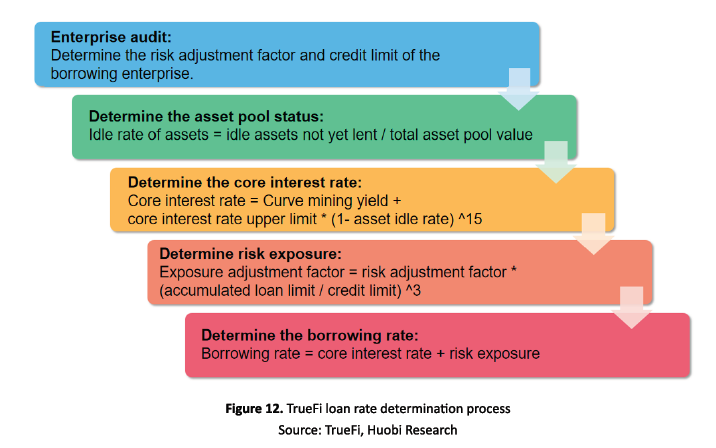

So far, TrueFi looks like a combination of Maple and GoldFinch: risk management is done on-chain through voting, and the risk manager bears the default risk first. However, the advantages of TrueFi are not limited to this. The borrowing rate pricing of Maple and GoldFinch is done off-chain, while TrueFi is done on-chain, as follows.

In general, when TrueFi calculates the borrowing rate on-chain, the liquidity of the loan pool and the credit risk of the borrowing company will be thoroughly considered, and the final borrowing rate will be determined by the following framework:

Borrowing rate = Benchmark rate + liquidity risk premium + credit risk premium

In this formula, TrueFi sets the curve mining yield without free losses as the benchmark interest rate, captures the degree of idle assets in the pool to measure liquidity risk, and finally determines the credit risk premium based on the company’s own reputation and credit exposure.

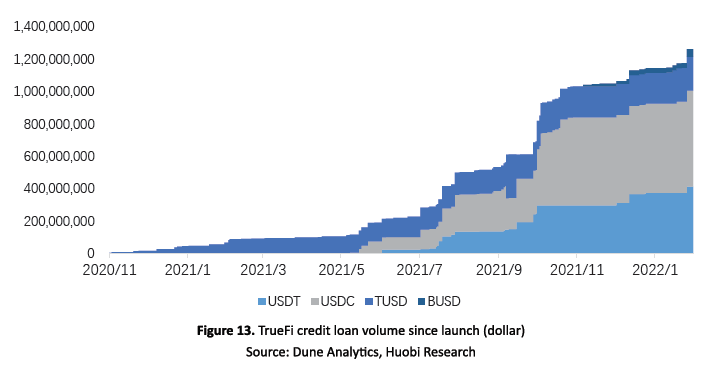

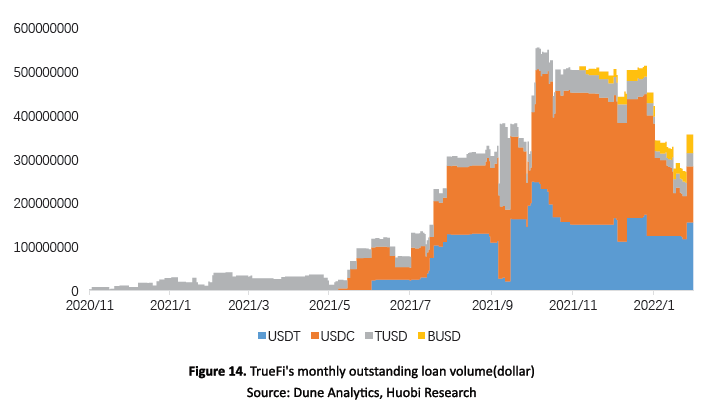

With the mechanism above, TrueFi obtains a greater advantage in the market. Although it has been online for only a year, its cumulative credit volume has exceeded $1.4 billion and total monthly credit exposure has stayed above $300 million, with no defaults at time of writing.

3. Future Development of Crypto Lending Market

Compared with excess mortgages loan protocols, on-chain crypto credit loans are more advantageous in terms of cost and threshold, aside from their immense development potential. The rapid development of Maple, GoldFinch and TrueFi in the past year have attested to this. On the other hand, for Maple, GoldFinch, or TrueFi, risk management and market mechanisms remain slightly inadequate. Therefore, the crypto credit market can be further improved in the following aspects:

i). Stepped-up risk management

The credit lending business relies heavily on risk management. However, the current credit lending protocols in the market are too crude in terms of credit risk management: Maple is managed by fund pool agents, but all of them are conducted off-chain, and the lack of transparency will itself generate huge risks; both GoldFinch and TrueFi ultimately manage credit risk through community voting, but this practice is still crude and simplistic.

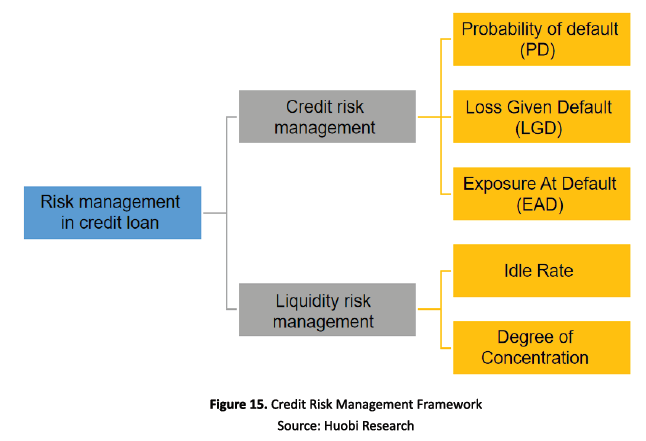

Following the development path of modern financial markets, the future credit lending markets can take guidance from the risk management framework of the Basel Accords. For stepped-up risk management on-chain, credit risk management, credit default probability, default loss ratio and other indicators could be calculated through internal rating and credit risk measurement models. The expected value can then be determined at loss and risk provision coverage. For liquidity management, this could be arranged in accordance with the rate of funds at idle and degree of concentration.

ii). Market-based mechanism for risk pricing

Poor risk management results in weak rate adjustments according to the market — and without an index for market pricing projects have no incentive to do so to protect borrower privacy. However, the fact is that through internal audit, the loan can be evaluated without disclosing the customer’s detailed financial information. With detailed rating and credit risk metrics, the market can be given a pricing reference, and market pricing could be achieved by Dutch Auctions.

iii). Lending to on-chain legal person

Due to KYC restrictions, current major credit protocols are only available to institutional customers who have done KYC off-chain. The purpose of KYC for credit loans is to confirm that the borrower is a natural or legal person with civil rights and civil conduct, and can be held liable for a breach of contract.

There is a common misunderstanding in the market that while on-chain borrowers are anonymous, their credit levels can be assessed based on on-chain data. However, such views fail to realize that the consequence of anonymity allows the borrower to avoid civil liability. Even with on-chain data analysis, the borrower still has a strong incentive to default.

Therefore, in the future, only two types of borrowers can be issued with on-chain credit loans: one is a natural person or legal person who has done KYC off-chain; the other is accountable corporates with substantial financial interests on-chain. Typical examples are the credit loans to DeFi head protocols and DAO organizations. The former has been realized, and the latter will be realized gradually in the future.

4. New options in the cryptocurrency lending market

In the future, in addition to the credit business introduced in this paper, another growth engine of the crypto lending market is to diversify the types of collateral, namely NFT lending. The main challenges in this business are the lack of liquidity and price discovery of NFT. We will cover NFT lending in detail in our next paper.

###

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as “Huobi Research Institute”) was established in April 2016. It is committed to researching and exploring new developments in the global blockchain industry. Its goal is to accelerate the research and development of blockchain technology, promote its applications, and improve the global blockchain industry ecosystem. Huobi Research Institute covers industry trends, emerging technologies, innovative applications, new business models, and more. Huobi Research Institute partners with governments, enterprises, universities and other institutions to build a research platform that covers the entire blockchain industry. Its professionals provide a solid theoretical basis and analyze new trends to promote the development of the industry.

Contact Huobi Research Institute:

E-mail: [email protected]

Official website: https://research.huobi.com/

Twitter: @Huobi_Research

Medium: medium.com/huobi-research

Telegram: t.me/HuobiResearchOfficial

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you need to quote the content of this report, please indicate the source. If you need a large amount of reference, please inform in advance (see “About Huobi Blockchain Research Institute” for contact information), and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.

繁体中文

繁体中文