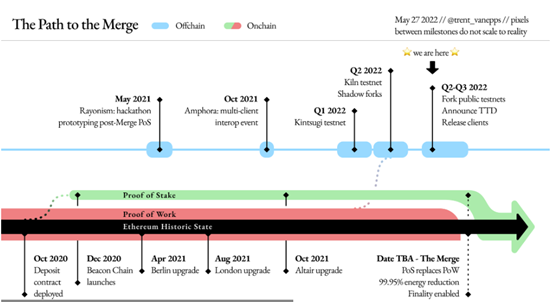

The Merge is a major milestone for the Ethereum 2.0 upgrade. The completion of the first “Bellatrix” brings the countdown to the second phase of its long-awaited Merge upgrade.

Here’s what we should know:

The Merge

The Ethereum will shift from Proof of Work (PoW) consensus mechanism to Proof of Stake (PoS), and at the same time, the Ethereum mainnet will merge with the Beacon Chain. This is an event known as “The Merge”. This transition is a two-phase process that the first one needs to be upgraded to “Merge Aware” through “Bellatrix”, which was completed on September 6th; the second phase will be the “Paris” upgrade, and the expected date is September 15th.

The “Paris” upgrade will shift the Ethereum mainnet to proof of stake after a final terminal total difficulty (TTD) 58750000000000000000000 is triggered. That will cause the suspension of PoW, and the PoS validators will maintain the network.

Photo Credit: Ethereum Foundation

Impact of the Merge

Reduced energy consumption: After the merger, it will be converted to a PoS mechanism which may reduce the energy consumption to consume about 2.62 megawatts per year, meaning it will use about 99.95% less energy than PoW.

Improved Transaction Speed: After the merger, the transaction speed is expected to be slightly faster. The time required to add a new block to the chain may drop to 12 seconds from 13.6 seconds and the transaction processing volume can be increased by 12%.

What is the ETH fork?

When the merge is completed, Ethereum will operate under a PoS mechanism that miners who previously maintained the Ethereum network will no longer be rewarded. As most miners have invested a lot in the mining equipment and the business, a potential phenomenon of “ETH Fork” may emerge as a newly forked ETH-PoW chain.ETH holders’ tokens or NFTs may obtain their forked version after the merge. Yet, whether it is feasible or not, we need to wait and see until the merge is completed.

As a Huobi Tech’s client, what should you pay attention to after the ETH hard fork?

As a secure and professional one-stop platform for digital asset, Huobi Tech endeavours to actively pay attention to the development of Ethereum upgrades and the potential forks.

Services for ETH and ERC-20 tokens will not be affected during the hard fork. But the market may fluctuate in response to the hard fork. Please be advised to act prudently.

There are two possible scenarios regarding the Merge:

1). No new token is created: Huobi Tech will confirm the stability and security of the Ethereum mainnet before recovering the deposit, withdrawal, margin loan, and crypto loan services for ETH.

2). The network forks into two competing chains, and a new token is created: Then the symbol ETH will be used in the ETH PoS chain. Huobi Tech will then send clients the forked tokens at a 1:1 ratio based on ETH balances snapshots taken before the Paris upgrade (approximately at the mainnet block height of 15,540,293 and around 2022-09-15 08:30 (GMT+8) (The expected time for reference only). The 1:1 forked tokens will be credited to clients’ fund accounts. Clients can review the account about the airdrop crediting of the forked token.

If there is a potential fork, what arrangements will Huobi Tech make?

Huobi Tech will airdrop the forked tokens to clients, and the airdrop amount depends on the sum of the snapshot ETH balances in the client’s main account and sub-accounts.

-The forked tokens will be credited to clients’ fund accounts. Clients can review the account about the airdrop crediting of the forked token.

-A single position (including open orders) of less than 0.003 ETH, as shown in balance snapshots, is not included in the forked token airdrops.

-The snapshot balances do not include the ETH assets that have not arrived in the destination accounts, are in the withdrawal process, or are already sold when the snapshots are taken.

Cautious Investment in times of the Merge

The Ethereum upgrade is a significant event in the cryptocurrency industry. During the hard fork, it may bring about market volatility and fluctuations. Any investment in times of the merge should be treated with caution.

English

English