Abstract

Fixed-rate, as a critical component in the financial derivative market, could be the anchor that secures future profit: Investors make a trade-off with more lucrative opportunities in the future to hedge the risk and obtain stability in income. In Web3, fixed-rate protocol can be classified into 3 categories: zero-coupon bond, separated principal and interest, and junior and senior bond. In this article, we will conduct thorough analysis on the realization process, pros and cons, and the status quo of the three modes. According to our analysis and research, current fixed-rate products have achieved phenomenal success with rather creative design. Although fixed-rate products scored quite well user number and TVL wise in their earlier launch phases, the drawbacks, such as low interest rate, intense competition, and lower overall attractiveness to investors have remained. Fixed-rate products must tackle this problem by thinking outside the box — by aligning the pricing scheme and integrating more lending protocols with higher interest.

1 Principles of Fixed-Rate

Since the 1960s, fixed-rate products have sprung up in the traditional financial market. A fixed-rate product is a financial derivative that remains at a constant rate during a loan or note period regardless to the market rate fluctuation and change in supply and demand. This type of product could not be more suitable for those investors with high risk aversion, as well as some traders: as the market is volatile all the time, fixed-rate products could be perfect for traders to create more diverse portfolios.

The pros of fixed-rate products are reflected in 3 aspects: 1. Hedge market risk in response to demand from users. When market rate is low, it becomes even more appealing to borrowers; 2. Predictable interest. Because the interest rate is transparent, it is straightforward for both borrowers and lenders to calculate, especially for borrowers as the cost of borrowing can be calculated before a decision is made; 3. Efficient fundraising. A stable fundraising premise can be achieved with such a product.

The cons can also be seen from the following two disadvantages: 1. The designers of the fixed-rate product must possess accurate valuation on the future state of the market before launch; 2. It is almost a foregone conclusion that if fluctuation appears, one party enjoys the perks while the other must swallow the loss. Borrowers may sometimes pay more than the floating rate, in such a case.

Similar to most financial products, while fixed-rate products could help investors avoid interest risk caused by market fluctuation, price volatility and liquidity risk remain. Since different roles are assigned to lender and borrower, market fluctuation could, in different circumstances, produce a gain to the lender against the borrower, and vice versa For example, the borrower could borrow at a cost that is lower than the rate at which the market rate is inclined to rise in the future.

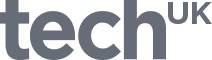

In DeFi, users yearn for more guaranteed profit, yet such a yearning is a paradox to the high volatility in the crypto market. DeFi products are in need of more precise modelling and calculations in order to achieve stability via strategic adjustment while satisfying investors’ appetite for high profits. As a result, in the design of a typical DeFi product, there exists an impossible trilemma balancing: risk, interest rate and stability.

2 Realization of Fixed-rate Protocols

In DeFi, three critical criteria must be taken into consideration when designing a fixed-rate product: 1. How to set the fixed interest rate, that is to say, how to price correctly; 2. How to achieve stability during market fluctuation, including the recovery of potential losses incurred from the protocol, and assurance of the profit for lenders/borrowers; 3. How to produce more profitability from fixed-rate products (i.e., among current fixed-rate products, interest rate provided by Notional is merely 3.9%, which lacks competitiveness in the market.). Among the three criteria, the third appears to be the most intricate, as investors care about profit above all else, regardless of how ideally the scheme is designed. An in-depth analysis is provided by dissecting the mechanisms of the following three representative projects in the DeFi fixed-rate battlefield.

2.1 Zero-coupon bond

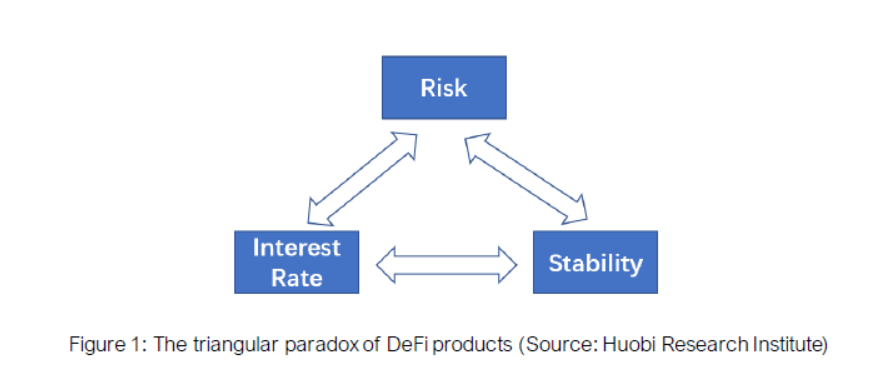

Fixed-rate lending products involve two factors: loan rate and savings rate. A classic case would be Notional Finance, which launched in 2020 but did not reach a high TVL until November 2021. It was first integrated into Coinbase Wallet in January 2022 and attracted mass attention. Currently, borrowing is available at an interest rate of 3.9%.

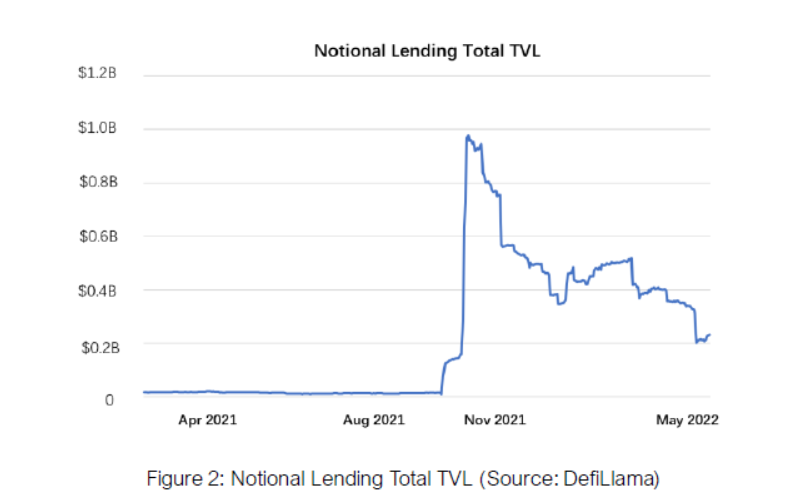

Notional is an example of zero-coupon bonds. Another type of token or bonds would be generated upon borrowing, which must be paid in fair value of the tokens or bonds in order to redeem the assets in collateral upon maturity. Not all the users are bound to the same interest rate, the difference is negligent; the only difference is caused by the slippage of the AMM scheme. Three types of roles exist in Notional protocol, and these exist in most lending protocols: borrowers, lenders, and liquidity providers (LP). Profits owed to LPs come from the trading fees in fund pools.

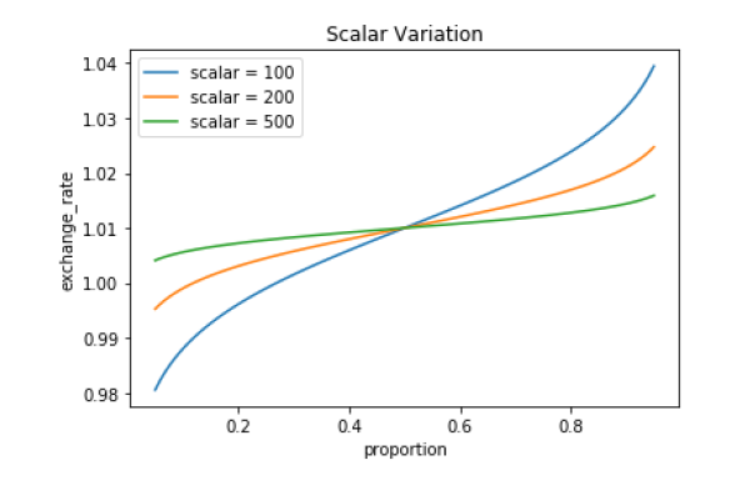

The peculiarity of Notional is the cocktail of the dynamic AMM scheme and time, which evolves the function to a smarter one. Based on different maturity levels, different AMM functions are manufactured, that is to say, various pools are generated according to various maturity dates. Thus, longer maturity could be paired with higher interest rates. Meanwhile, higher interest rates will appear when borrowers flock into the pool — a simple supply and demand curve. The interest rate will be fixed at the moment of lending/borrowing, the scheme will adjust the interest rate for next transaction as the total amount of loanable funds has changed.

fCash is enabled in AMM pools as a necessity for lending. fCash follows the ERC 1155 standard. The right to receive fCash can be transferred, which is commensurate with, de facto, a fixed-rate bond. According to the on-chain data, Notional received minimal acceptance.

The intricate algorism of Notional could indeed solve: 1. The balance of supply and demand; 2. Longer maturity and larger amount receive higher interest rate. The introduction of fCash recalls the zero-coupon bond in traditional financial market; as an intermediary in the protocol, it becomes the accounting unit where the pricing of the lending/borrowing decides the amount of fCash to be collected, either in positive or negative number. The protocol winds up by counting the amount of fCash payable at maturity, which is simply 1 fCash to 1 USDT, rather than initiating complicated calculations on the interest stored upon lending, not to mention, there must be some allowance for the storage of the interest rate at the exact moment the transaction went into effect. fCash stands for the right to claim the positive or negative cash flow at a certain point of time in the future. The interest rate of Notional is co-ensured by both parties, in which the fCash shall appear with the same amount in pairs but with different sign and adds up to zero, akin to credit and debit in accounting. In a later Version 2, fCash is valued by cToken, which the pricing unit is derived from the settling unit.

The application of AMM scheme and fCash as an intermediary is a reflection of the traditional zero-coupon bond in the traditional financial market, and could solve lending/borrowing imbalance and interest rate settling problems. One thing worth noting is that actual borrowing rate could have a huge spread because of an over slippage. From the perspective of borrowers, Notional’s scheme is problematic. Firstly, instance, the intricate scheme of zero-coupon bond with the intermediary, fCash, does function as if it were no different from other lending protocols when operating. Second, the input of collateral is combined with the borrowing to avoid forced liquidation. That is to say, when adding collateral, users will be unable to respond in a timely manner. Moreover, the primary criterion a in fixed-rate realization is to set rational maturity. This remains a challenge for product designers: rational prediction on the market, and a rational interest rate that users are willing to borrow at. Users face a dilemma when choosing products as there are a few maturity options. Besides, one of the most critical problems is account balance handling: to handle system accounts inside and user accounts outside. For example, actions must be made to balance the relationship between the two in order to provide larger liquidity and balance of income, and obtain convenience when calculating liabilities and assets in the two accounts.

However, progress has been seen in V2:

(1) In V2, the account settles in cDai and cUSDC, cToken, further elevating the capital turnover. cToken is an invoice of Compound savings, which possesses higher potential for appreciation. The spread between cToken and its underlying assets is, in fact, a variant of floating rate in another cover. In V2, being proven again more indirectly, a fixed interest rate is unsustainable to any party whatsoever.

(2) In V1, LP bears more burden to the risk with less income, which is mainly from the transaction fees and the change in net holdings. In V2, nToken is introduced, and LP can thus enjoy more diversified profits. nToken represents LP’s equity, to be more specific, the right to receive profits, and can be redeemed without any constraints, and mortgaged as collateral in Notional protocol.

In terms of fixed-rate product per se, Notional demonstrates several disadvantages: 1. Low interest rate due to the inefficient fund turnover. Even though the cToken is integrated and receives extra income due to its adoption of the Compound protocol, overall income is low as a whole. Compared to other lending protocols, a 4% fixed interest rate is not competitive enough to attract more users. 2. Inflexible maturity. It supports only two maturity periods: three months and six months which is insufficient for both lenders and borrowers.

2.2 Separated principal and interest

Projects of separated principal and interest are represented by Element, Pendle, etc., characterized by tokenizing principal and interest. Principal token (PT) is put up for sale at discount, whereas yield token (YT) functions to broaden the income spread yet remains under liquidation line.

(1) Principal token (PT)

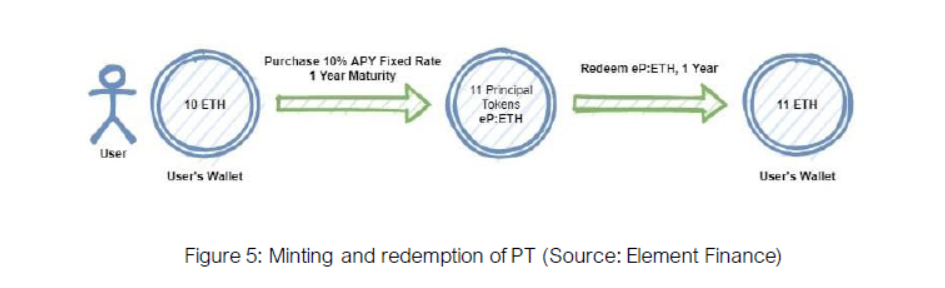

Separated principal and interest founded a market for fixed interest, similar to how the issuance of zero-coupon bonds at discount allows liquidity providers could release the liquidity from the principal and buyers could secure future income in advance. PT provides assets with fixed maturity, such as BTC, ETH, USDC or DAI. At maturity, the face value can be redeemed in full.

For PT buyers, PT can be treated as a fixed-rate product that sets off the market rate fluctuations.

(1) Yield Token (YT)

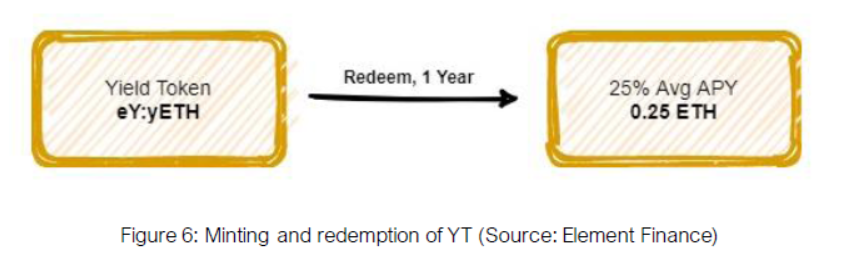

The value of the underlying assets is always equal to the sum of PT and YT: PT secures the fixed-rate part, whereas YT fluctuates with shifts in the market rate. PT guarantees a fixed-rate, and YT reflects the return taking into account the risk of market rate fluctuation.

The market rate never rests. That is to say, the actual return provided by YT remains unclear until the exact moment of maturity. When the return from the underlying assets is greater than the discount off PT, we see a positive return on YT, and vice versa.

At maturity, the redeemed value from the sum of PT and YT denotes the value of the underlying assets. YT can only redeem the difference between the income from underlying assets and the value of PT. When there is a premium or discount between the sum of PT and YT and the value of the underlying assets, it becomes appealing for arbitragers to engage with the product and set off the gap.

YT represents the variable part in the interest rate of the underlying assets; as the principal part is minted to PT, YT contains more price volatility and could therefore play a role in the leveraging of interest rate.

For interest rate traders, the leverage of YT could be utilized in going long or shorting. For liquidity providers, selling PT and holding YT could increase fund turnover while limiting risk exposure.

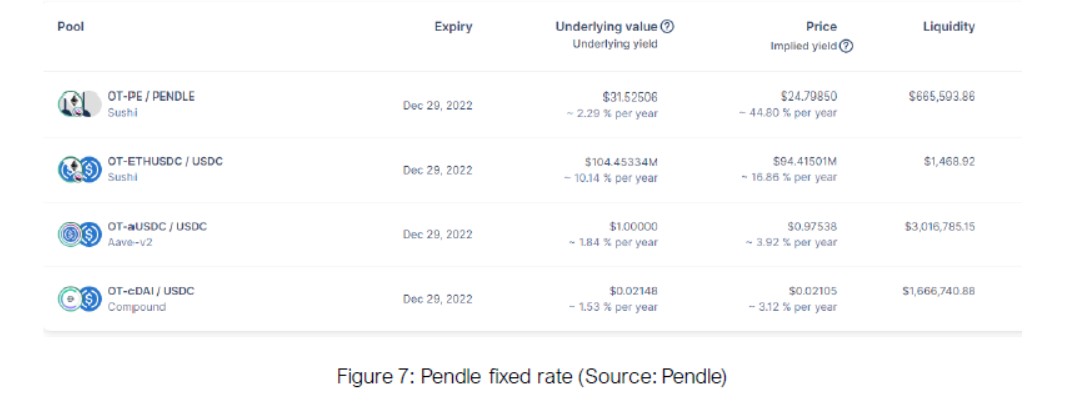

(1) Pricing

The pricing of PT and YT is of utmost significance in the separated principal and interest mode, and it remains the bottleneck for this protocol type.

In a perfect world, YT employs an average interest rate based on rational market prediction, with other factors added for adjustments. But difficulties with market predictions and the forementioned other factors exerted on YT simply cannot be quantified. Besides, YT’s leverage properties coupled with the involvement of opportunists adds even more difficulty to pricing YT.

However, the pricing of PT can be arrived at by a fair anticipation of the market: an acceptable fixed income level. It is a double-edged sword: a high level of fixed income will have impact on the risk/return ratio of YT, whereas a low level of fixed income is simple not appealing enough and could eventually lead to overstock.

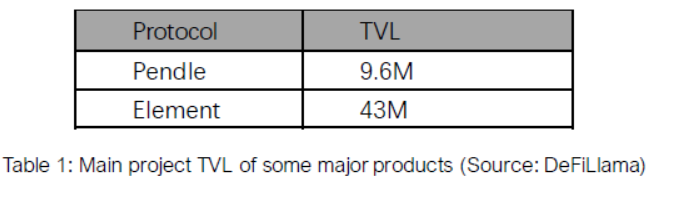

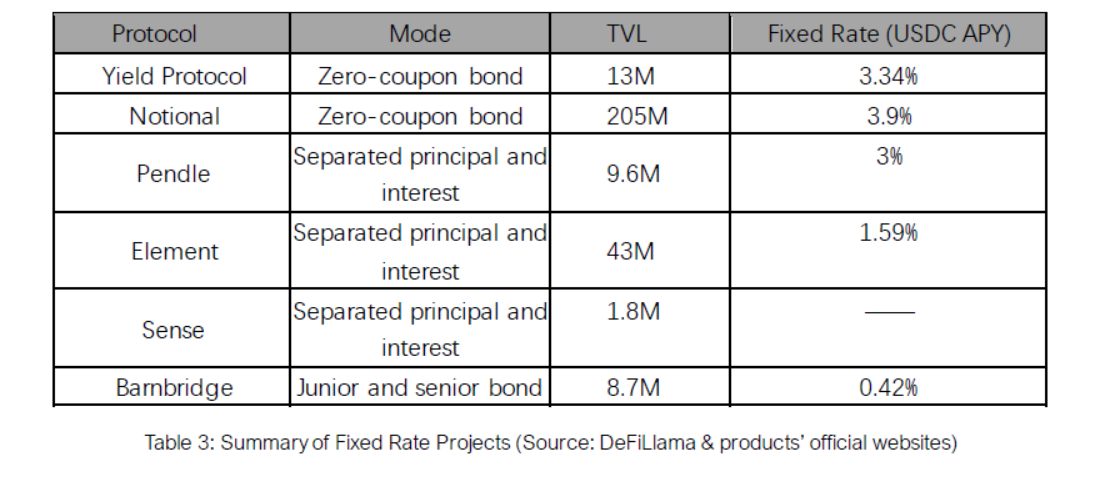

Take Pendle as an example. The APR of stablecoins is merely 1.5%-1.8%, and TVL remains in the million tier and hard to proceed. The TVL of representative projects, Pendle and Element, are 9.6M and 43M, respectively, as demonstrated in the following table.

2.3 Junior and Senior Bond

Junior and senior bond is frequently applied in the traditional financial market. To be more specific, funds are classified into different tiers with different risk aversion levels, namely, transferring extra risk exposure from investors that favor fixed income to those willing to be exposed to more risky opportunities with higher return expectation.

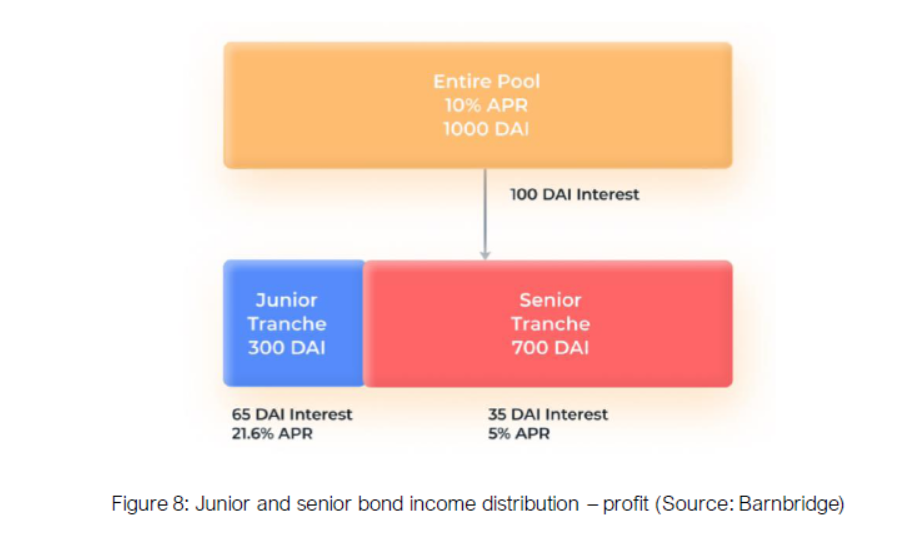

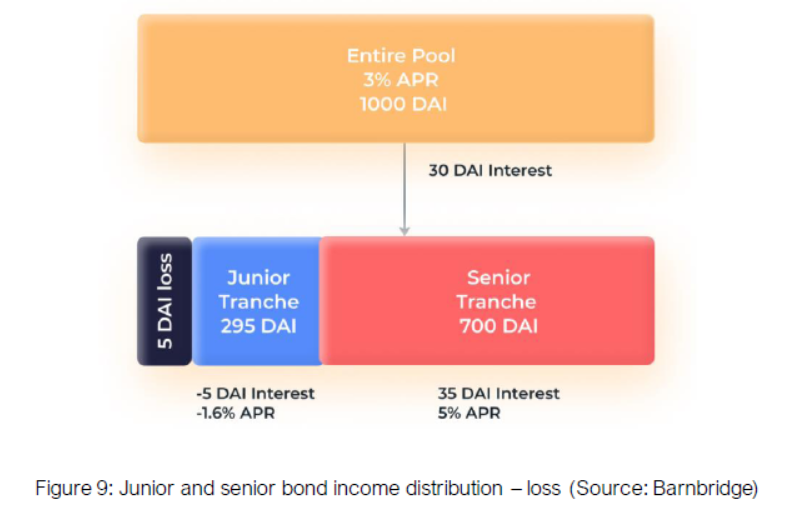

In a typical junior and senior bond protocol, there are two types of fund pools: Junior Tranche and Senior Tranche. Junior Tranche is riskier so that leveraged variable interest rate can be achieved, whereas in Senior Tranche, only a fixed income is desired with relatively low risk exposure. The fixed income of Senior Tranche stems from the lending from Junior Tranche and Senior Tranche. When the average lending rate in the market is higher than the fixed income payable within the lending period, and the income generated from Senior Tranche is sufficient to pay off the interest upon maturity; the rest will be distributed to users in the Junior Tranche.

When the lending rate is lower than the fixed interest rate before maturity, and income from Senior Tranche is insufficient to write off the interest payable, the income from Junior Tranche will compensate the interest owed to Senior Tranche, including the principal; the remainder will be allocated to users in Junior Tranche.

Junior Tranche reinforces leveraged variable interest rate to return, the overall income is calculated by the sum of the principle and profits in Junior Tranche minus whatever is left after the payment of principal and interest payable to Senior Tranche. When the average market rate is higher than that of the fixed interest payable, Junior Tranche could enjoy interest income from its own principal plus partial interest from Senior Tranche as an extra reward from leveraging. But when the average market rate is lower than that of the fixed interest payable, income from Junior Tranche must pay off the principal and interest to Senior Tranche primarily, which results in a lower income for Junior Tranche, and sometimes, a principal loss.

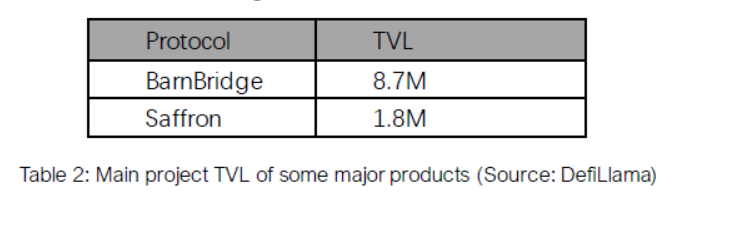

Junior and senior bond is represented by BarnBridge and Saffron, with TVL of 8.7M and 1.8M, respectively, as illustrated in the following chart:

2.4 Summary of Projects

After close analysis of each mode, Notional stands out in the lending protocols with considerate TVL, while uptake for the others appears comparatively depressed. In other words, funds in the market have moved away from them. The fundamental reason is that during the bull market, these fixed-rate protocols have no competitive advantage and offer extremely low yields relative to other DeFi protocols. While people in the crypto market are largely risk-inclined, fixed-rate products were not popular under bull market conditions.

A comparison was made on the change in TVL and interest rates of various projects before and after the collapse of Terra: fixed interest rate and TVL are decreasing gradually with no reflection on market morale. It indicates that even though the crypto market is entering the bear market, fixed income products are not sought after by funds. We three main reasons for this apparent aversion: 1. The large fluctuations in the entire crypto market may bring systemic risks; 2. Loan-type fixed-rate products will also face liquidation risks; 3. The diversity of fixed-rate product structures means that users need more time to figure out different investment strategies.

1 Status quo of fixed-rate product

The fixed-rate market shares the following characteristics:

3.1 Low Fixed Interest Rate

Despite the various modes, the issue of low fixed interest rates is commonly seen in the market. The fixed interest rate of stablecoins is roughly 1–2%. In DeFi, major players, such as AAVE and Compound, the fixed rate of stablecoins from the two floats in the 5%-7% range. The risk management philosophies of the two has been tested by the market, and the products provided by the two have become relatively risk-free. Although fixed interest protocols could lock-in an interest rate, it differs from the mainstream floating rate protocol, which appears to be less attractive, as validated by low TVL of various current fixed-rate protocols.

3.2 Intense Competition

Fixed-rate product is facing competition from professional investors and reputed institutions, who usually specialize in building portfolios with various financial products. Competition lies not only with the on-chain lending protocols, but includes various financial products on TradFi, whose return is higher yet less risky; sometimes the risk/return ratio of fixed-rate protocols could deviate from the normal. Considering the interest hike by the US Fed Reserve, investors will be more than able to locate fixed income products from venues other than the fixed income protocols in blockchain.

2 Prospective view

Speaking of fixed-rate product, more issues await to be dealt with:

(1) Pricing

Low interest remains a headache for fixed-rate and it impedes TVL of fixed-rate products from further growth. The stablecoin interest rates of AAVE and Compound can be viewed as risk-free rates in the market, yet the rates provided by fixed-rate products appears to be extremely low. They can only thrive when the fixed interest rate is higher or just below the risk-free rate that funds will start to give a glimpse on the product, and the rationality behind the pricing scheme is in urgent need of revision.

(2) Integration of more lending protocols

The increase in interest rate could be achieved by fair pricing, redistribution of profits to participants, and increasing the profit from underlying assets. Vast majority of current mainstream players adopt AAVE and Compound as the pool for underlying assets to receive a higher interest rate, and this could attract more lending protocols to the pool. Meanwhile, a larger leverage can be provided for those opportunists, accompanied by higher interest rates.

DeFi protocols did not perform that well this year; a downward slope has been seen both in TVL and token price. Increase the efficiency of fund usage is a perpetual question to be answered periodically for DeFi players. More specifically, to facilitate the collateral and benefit from market-making activities and profit from other protocols.

(3) Challenge of sustainable higher profits

In the next year or two, pessimism will envelope the market. The downfall of Terra has aggravated the move to a bear market. A fixed-rate of 20% from Anchor is a story from the past, which has proven its unsustainability. From traditional financial market point of view, fixed-rate products are the final option of many in the bear market. But for DeFi, what’s more important is how to convince users with the sustainability and a relatively rational and high return at the same time. This will be the touchstone for some of the projects. After the FOMC meeting, the NFT market saw abnormal heat. Could there be a fixed-rate product integrating NFT that would breathe new life into the industry? Fixed-rate products have huge potential on the market, especially for future institutional investors that may enter the market. Besides, the logic has long been proven right in the traditional financial market; the on-chain fixed-rate protocols are still in the hatch phase, and more innovative fixed-rate products will emerge in the market. We yearn for that day.

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as “Huobi Research Institute”) was established in April 2016. Since March 2018, it has been committed to comprehensively expanding the research and exploration of various fields of blockchain. As the research object, the research goal is to accelerate the research and development of blockchain technology, promote the application of blockchain industry, and promote the ecological optimization of the blockchain industry. The main research content includes industry trends, technology paths, application innovations in the blockchain field, Model exploration, etc. Based on the principles of public welfare, rigor and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms to build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical basis and trend judgments to promote the healthy and sustainable development of the entire blockchain industry.

Official website:

Consulting email:

[email protected]

Twitter: @Huobi_Research

https://twitter.com/Huobi_Research

Medium: Huobi Research

https://medium.com/huobi-research

About Huobi Tech

Huobi Technology Holdings Limited (“Huobi Tech”, Stock Code: 1611.HK) was listed on the Main Board of the Stock Exchange of Hong Kong Limited in November 2016. Actively developing the blockchain ecosystem and virtual asset ecosystem, Huobi Tech is committed to becoming the leading one-stop compliant virtual asset service platform. Huobi Tech currently offers data centre services, cloud-based services, SaaS, virtual asset management, trust & custody, OTC brokerage, lending, trading platform and other related services.

Official website:

About EmergentX

EmergentX strives to be Asia’s most authoritative digital asset insight and advisory platform at the centre of digital asset adoption.

Headquartered in Hong Kong and supported by Cyberport, we cut through the complexities of digital assets to deliver valuable insights to organizations across geographies.

Our community — global investors, institutions, governments and digital asset natives — depend on us for institutional-grade insights to determine how to accomplish their objectives.

Official website:

Insights | Community | Events

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you need to quote the content of this report, please indicate the source. If you need a large amount of reference, please inform in advance (see “About Huobi Blockchain Research Institute” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.

English

English